The Home Loan Process

Demystifying Home Loans

If you haven’t experienced it before, the home loan process can feel overwhelming, but our agents will help you stay informed throughout the process, from pre-approval to closing. The first thing to do is consult with a mortgage specialist (or two). If you don’t already have someone in mind, we partner with some of the best lenders in the industry, and we’d be happy to introduce you, so you’ll be taken care of.

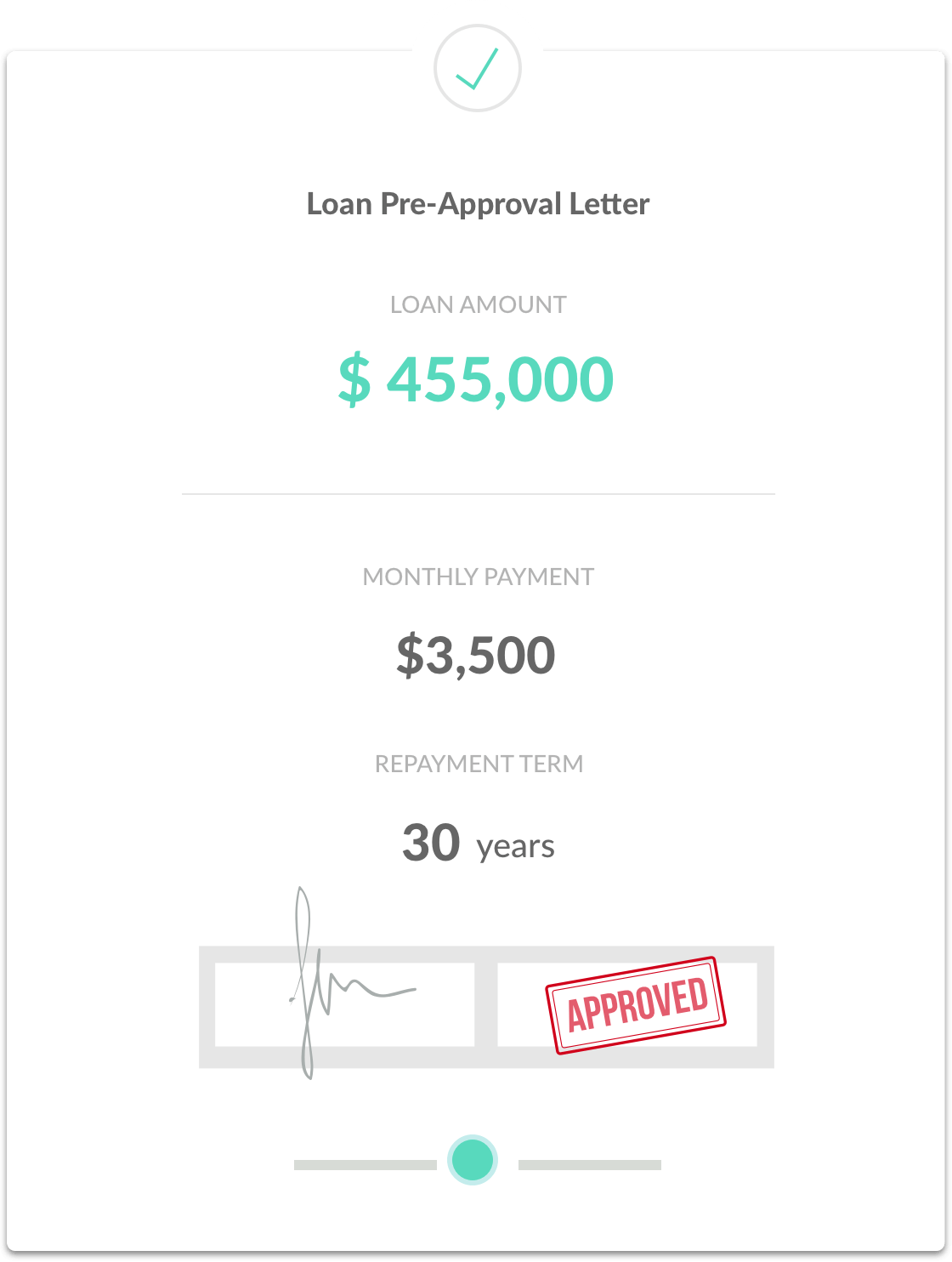

Get Pre-Approval

Before you start looking for a home to buy, it’s a good idea to meet with your Loan Officer to get pre-approved for a loan amount. At this stage, the lender gathers information about income, assets and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, W-2 forms, pay stubs, Federal Tax Returns and recent bank statements. There are a variety of different loan programs, so make sure to get pre-qualification for the specific programs that best suit your needs.

We Help You Get The Best Loan

Start the Process

We’ll help you find the best local loan officer to get you competitive rates and the programs that best fit your individual needs. Fill out this form and we’ll connect you with a lender today!

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

Keller Williams | DRE#02029039

Our philosophy is simple – clients come first.

We pledge to be in constant communication with our clients, keeping them fully informed throughout the entire buying or selling process. We believe that if you’re not left with an amazing experience, we haven’t done our job. We don’t measure success through achievements or awards, but through the satisfaction of our clients.

Each office Is independently owned and operated.

© 2024 Eloise Middleton. All Rights Reserved.

Powered by

California Concierge